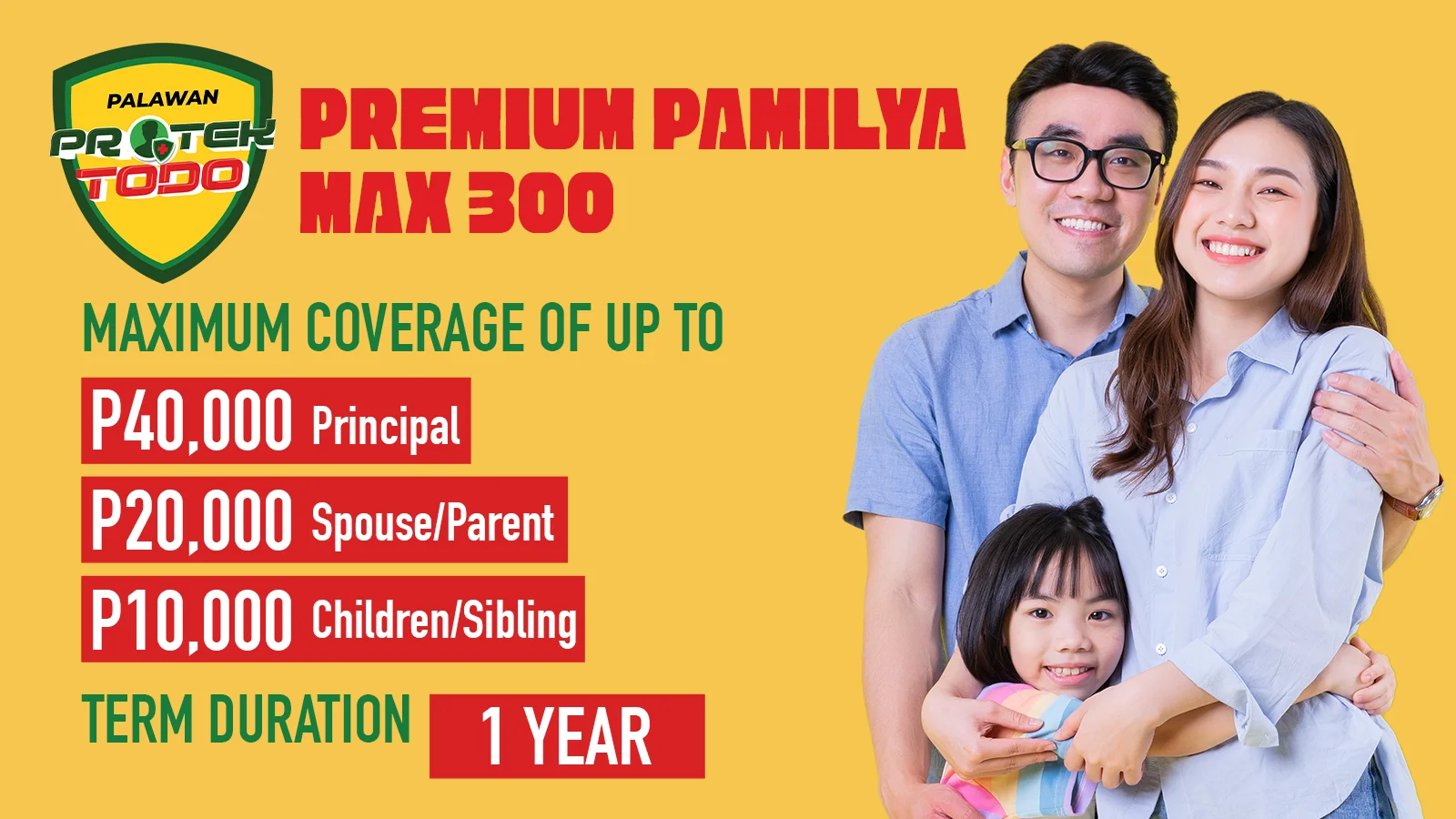

| Benefits | Principal | Spouse/Parent | Child/Sibling |

|---|---|---|---|

| Death Due to Accident Including Unprovoked Murder and Assault |

₱30,000.00 | ₱15,000.00 | ₱10,000.00 |

| Death Due to Motorcycle Accident | ₱5,000.00 | ₱5,000.00 | ₱2,500.00 |

| Permanent Disablement or Dismemberment due to Accident |

Up to ₱30,000.00 (subject to schedule) |

Up to ₱15,000.00 (subject to schedule) |

Up to ₱10,000.00 (subject to schedule |

| Permanent Disablement or Dismemberment due to Motorcycle Accident |

Up to ₱10,000.00 (subject to schedule) |

Up to ₱5,000.00 (subject to schedule) |

Up to ₱5,000.00 (subject to schedule) |

| Burial Benefit due to Accidental Death | ₱10,000.00 | ₱5,000.00 | ₱2,500.00 |

| Cash Assistance due to Natural Death/Death due to Sickness (Conditions May Apply |

₱5,000.00 | ₱2,500.00 | ₱2,500.00 |

| Educational Assistance for Beneficiary Due to Accidental Death |

- | - | ₱2,500.00 |

| Fire Assistance | ₱5,000.00 | - | - |

| Annual Premium | ₱100.00 | ||

TERMS and CONDITIONS

- Insured can avail up to five (5) policies.

- Eligibility: Principal must be 17 to 70 years old.

- Accidental death outside the Philippine territory is covered if the insured who availed the product went abroad as Overseas Filipino Worker (OFW).

- Motorcycling is covered except under any of the following instances: for racing purposes, under the influence of drugs or alcohol, with more than one (1) back rider, and driving without a valid driver's license.

- Permanent Disablement or Dismemberment due to accident: percentage of the sum insured corresponding to the bodily injury suffered, based on the Table of Benefits.

- Educational Assistance due to Accidental Death: for qualified dependent who at the time of Insured’s death is a full-time student. Must be unmarried and between 3 and 21 years old.

- Cash Assistance due to Natural Death is covered except pregnancy-related causes, AIDS and suicidal cases. Pre-existing conditions shall be covered after 6 months of continuous coverage. Policy conditions shall apply.

DECLARATION OF WORDINGS: A claim arises directly or indirectly as a result of a Pre-existing condition is not covered.

A Pre-existing condition is an illness, injury, condition or symptom:

- That is known to the Insured and/or policy owner one (1) year prior to the commencement of the policy or

- For which the Insured had consulted a medical practitioner prior to the commencement of the policy, or

- For which the reasonable person in the Insured position would have consulted a medical practitioner prior to the commencement of the policy.

Pre-existing condition may be covered under non-accidental death with 180 days waiting period.

Waiting Period – is defined as the period from inception of initial policy or reinstatement date whichever is later.

EXCLUSIONS

The Policy will not cover any loss or expense caused by or resulting from:

- Intentionally self-inflicted injury, suicide or any attempt thereat while sane or insane.

- War, invasion, act of foreign enemy, hostilities, or warlike operations (whether war be declared or not), mutiny, riot, civil commotion, conspiracy, rebellion, revolution, insurrection or military or unsurped power.

- Provoked Assault

- Congenital defects and conditions

- Engaged in any military duties or naval operations, police and civilians with peace and order duties or combatant duties or trainings

- Motorcycle related injuries or loss of life with expired or invalid driver’s licensed.

- Driving under the influence of prohibited drugs or alcohol.

- Sabotage and Terrorism is not covered

- Major disease outbreak, epidemic or pandemic (SARS, CORONA, EBOLA, BIRD FLU, and other dreaded diseases)

These are only some of the exclusions. Complete listings are in the issued policy.