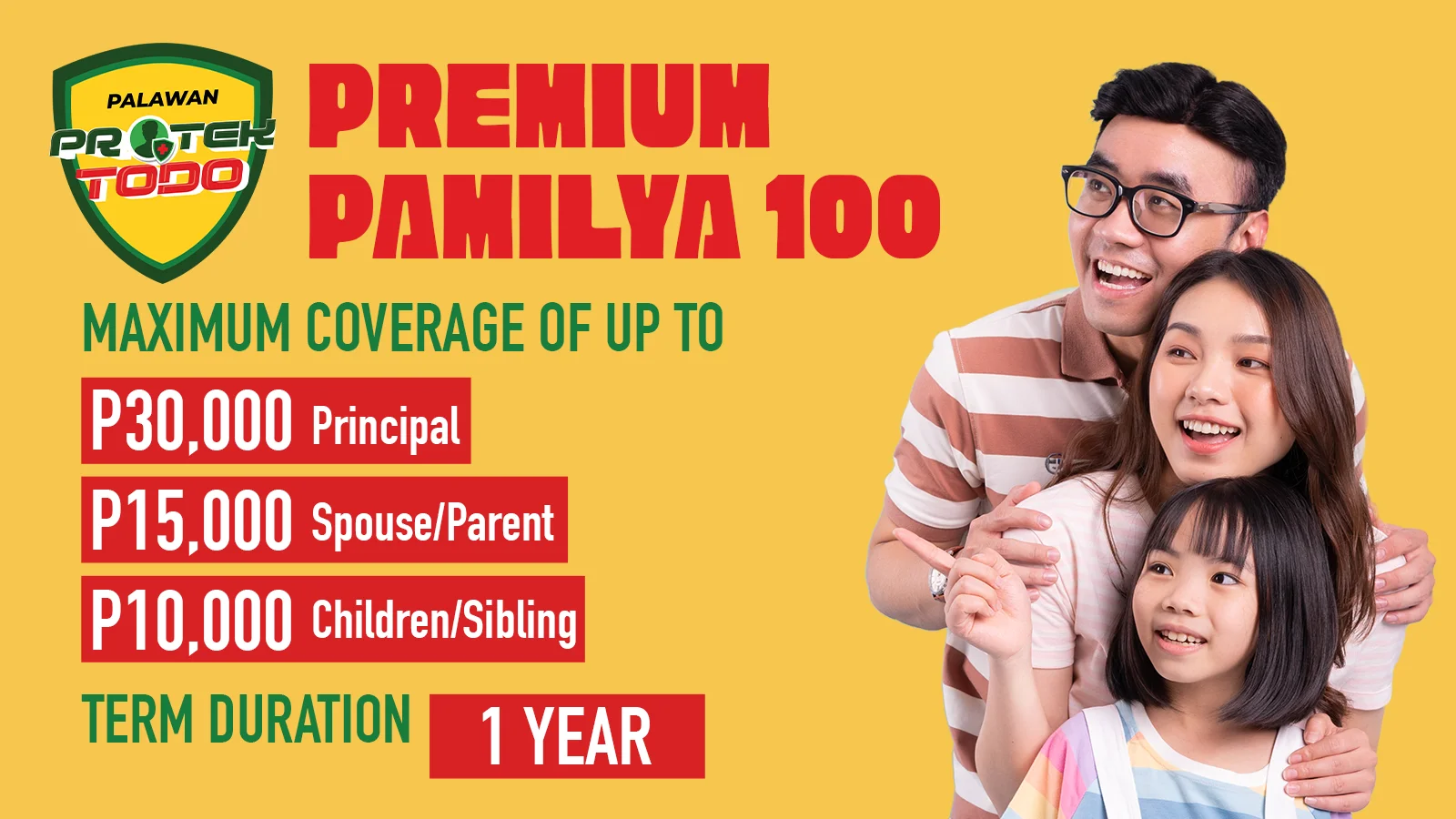

| Benefits | Principal | Spouse/Parent | Child/Sibling |

|---|---|---|---|

| Accidental Death | ₱40,000.00 | ₱20,000.00 | ₱10,000.00 |

| Accidental Disablement & Dismemberment | Up to ₱40,000.00 (subject to schedule) |

Up to ₱20,000.00 (subject to schedule) |

Up to ₱10,000.00 (subject to schedule) |

| Unprovoked Murder & Assault | ₱20,000.00 | ₱10,000.00 | ₱5,000.00 |

| Accidental Medical Reimbursement | Up to ₱8,000.00 |

Up to ₱4,500.00 |

Up to ₱3,500.00 |

| Burial Benefit due to an Accidental Death | Up to ₱10,000.00 |

Up to ₱5,000.00 |

Up to ₱3,000.00 |

| Death due to COVID 19 (Conditions may apply) | ₱1,000.00 | ₱1,000.00 | ₱1,000.00 |

| Education Assistance due to accidental death | ₱2,500.00 /child max of 4 |

₱1,000.00 /child max of 4 |

- |

| Unprovoked Murder & Assault | ₱10,000.00 | ₱5,000.00 | ₱5,000.00 |

| Cash assistance due to residential fire | ₱5,000 | ₱1,000 | - |

| Annual Premium | ₱300.00 | ||

TERMS and CONDITIONS

- Insured can avail up to five (5) policies.

- Eligibility: Principal: 17 to 70 years old.

- Accidental Medical Reimbursement: only if bodily injuries resulted from accident.

- Burial Benefit: for accidental death only.

- Fire Assistance Benefit: limited to the insured's declared address and occupied dwelling.

- Dengue and other insect bites: not covered.

- Educational Assistance due to Accidental Death: for qualified dependent who at the time of Insured’s death is a full-time student. Must be unmarried and between 3 and 21 years old.

- Permanent Disablement or Dismemberment due to accident: percentage of the sum insured corresponding to the bodily injury suffered, based on the Table of Benefits.

- Motorcycling is covered except under any of the following instances: for racing purposes, under the influence of drugs or alcohol, driving without a crash helmet, and driving without a valid driver's license. • Death Due to Corona Virus (COVID-19): If the Insured dies within one year from the date of infection. Policy conditions shall apply.

Policy Conditions:

A Pre-existing condition is an illness, injury, condition or symptom:

- Age Eligibility is one (1) to seventy (70) years old

- Must not be suffering from the following diseases prior to diagnosis of being positive with COVID-19 infection. With :

- Hypertension, Cardiovascular Disease, Diabetes, Respiratory Disease, Cancer, Kidney Injury/Disease.

- Coverage is applicable only in the Philippines and in countries with a low infection rate (below 50 cases) based on the daily report of the World Health Organization

EXCLUSIONS

The Policy will not cover any loss or expense caused by or resulting from:

- Injuries arising out of the Insured engaging in Dangerous sports which means fighting or self-defense sports, (semi) professional sports, racing of any kind other than on foot, mountaineering expeditions and any other sport involving an exceptional risk of accidents are NOT COVERED under the proposed plan.

- Work-related Injuries/Disabilities of Persons who belong under the following categories are NOT covered under the proposed plan: Security/Military personnel, people in the Police force, Barangay Tanods, crew members of vessels/aircraft, professional athletes, professional entertainers (including actors), window cleaners, divers, loggers, fireman, public utility drivers, pilots, rangers, acrobats/stuntmen, national journalists/news reporters, off-shore oil or gas rig worker, tree feller, politicians, other known celebrities/personalities, asylum attendants, aviators, boilermen, detectives, explosive makers, fishermen, loggers, miners, sailors, sawmill workers, secret service personnel, woodworking machinists, and underground workers, while performing their task as such.

- Provoked Assault.

- Seaman/vessel crewmembers and any offshore activities/trainings.

- Total Asbestos Exclusion Clause.

- Death or disablement of bodily injury, occasioned by or happening through:

- War, Invasion, Act of Foreign Enemy, Hostilities (whether war be declared or not), Civil War, Rebellion, Revolution, Insurrection, Mutiny, Military or Usurped Power, Riots, Strikes, Military or Popular Rising;

- Suicide or Attempted Suicide (whether felonious or not, sane or insane), Hernia, Alcoholism, Intoxications, Drugs, Intentional Self-injury, Insanity, Diseases Bacterial or Viral infections (except pyogenic infections which shall occur through an accidental cut or wound and due to coronavirus (COVID19);

- Poison or any poisonous substances accidentally or otherwise taken, administered, absorbed, or inhaled;"

- Death or disablement or bodily injury occurring whilst the Insured is travelling in an aircraft other than those licensed for public passenger service and operated by a regular Air Line on a published schedule flight over a regular air route between two established airports and in which the Insured is travelling as a ticket-holding passenger.

- Death or disablement or bodily injury, consequent upon the Insured engaging in the making or handling of explosives or upon being engaged as a custodian of explosives.

- Death or disablement or bodily injury, consequent upon the Insured's commission of or attempt to commit a felony or consequent upon the Insured's being engaged in an illegal occupation or performing an unlawful act.

- Arson

These are only some of the exclusions. Complete listings are in the issued policy.